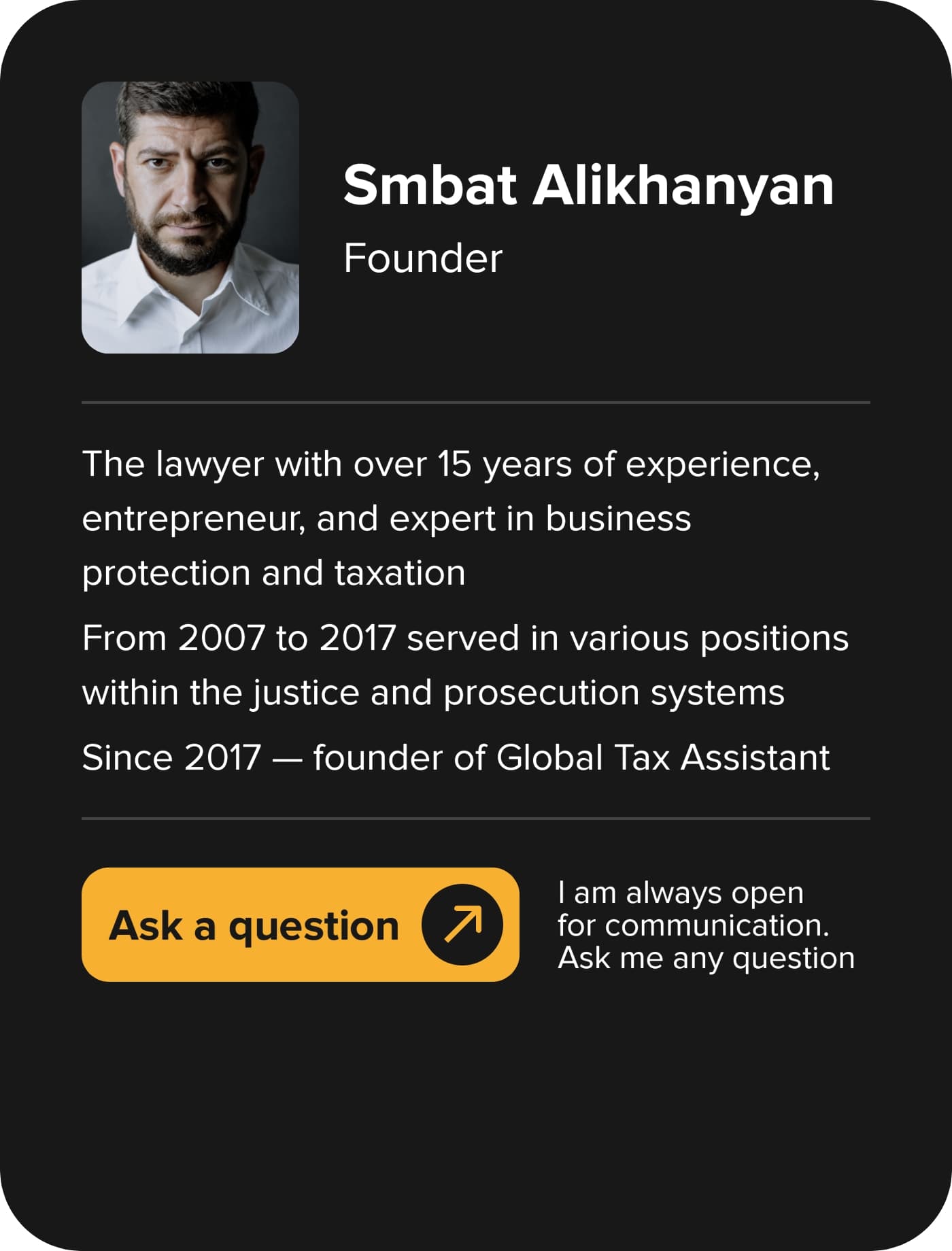

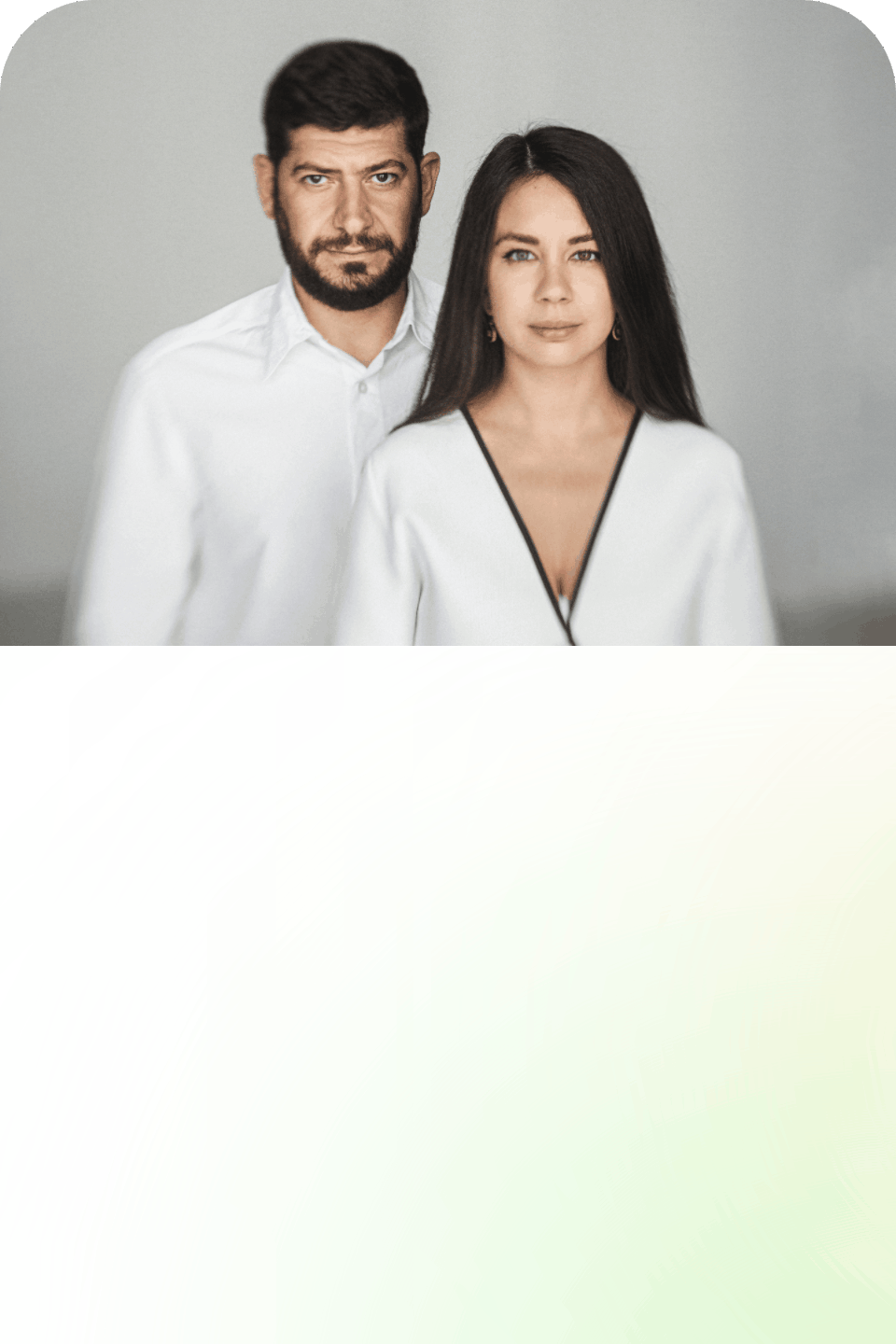

Smbat Alikhanyan

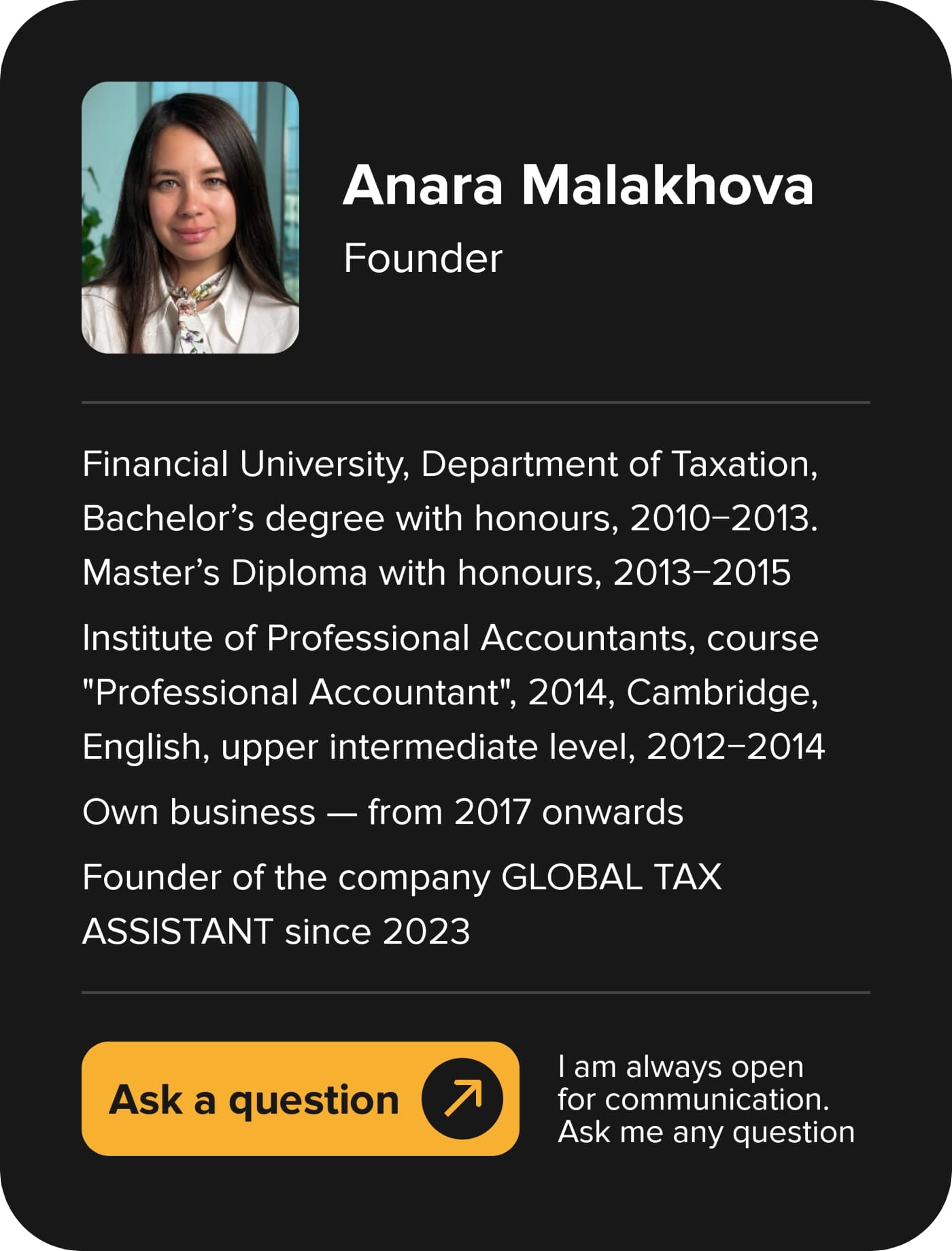

Anara Malakhova

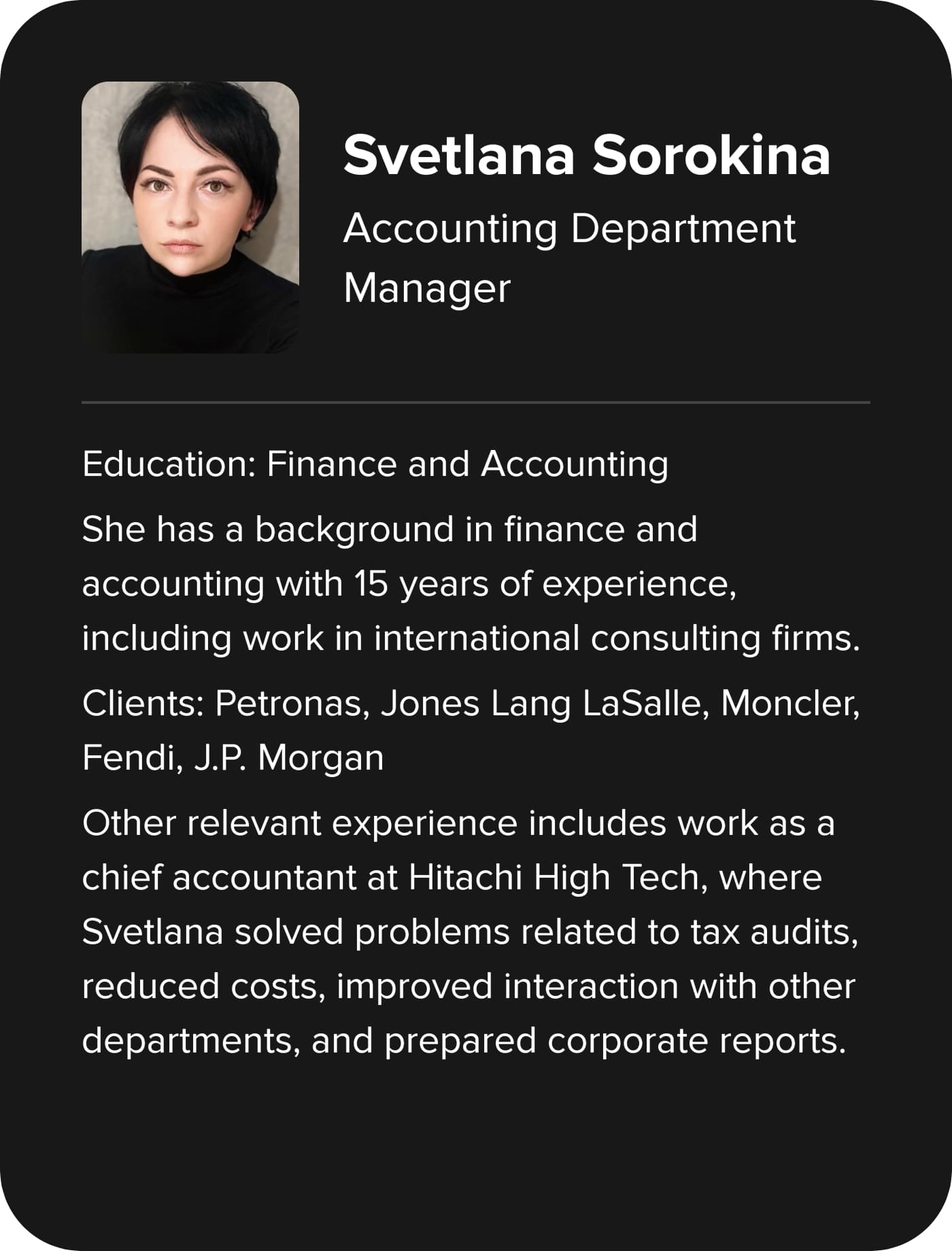

Founders of Global Tax Assistant

Business support

in the UAE and the GCC region

We will take care of all accounting, legal,

and financial matters so that you can focus

on what really matters

Get a 20% discount from Mastercard on comprehensive bookkeeping services

>250

clients

24/7

legal services

5 years

of experience in GCC

We guarantee results

or we'll cover penalties

Expertise

of the Big Four

A team with extensive experience in the Big Four global consulting firms

24/7 support and consultations

via phone, Whatsapp and Telegram throughout the entire period of cooperation

Flexible payment system

Customized tariff and payment options, tailored to the unique requirements of the business and the selected services

Absence of language barrier and cultural differences

Employees with knowledge of the cultures and languages of European and Persian Gulf countries

Benefits of working with us

Doing business in the entire GCC region

Selecting the appropriate jurisdiction individually for your business

UAE

Saudi Arabia

Oman

Bahrain

Qatar

We assume full responsibility

for timelines

and quality of work

All terms and deadlines are fixed in the contract

In case of any penalties due to our fault, we will fully reimburse your expenses

We guarantee

that you will be able

to enter a new jurisdiction properly while complying with all legal requirements

We complete

all business tasks

in the Gulf countries

Audit of financial statements

renewing a license

submitting reports to government agencies for the purpose of providing information on controlled foreign companies to the owners

Financial accounting

analysis of financial data

implementation of a transparent system for monitoring financial indicators

minimizing business costs

Accounting and Tax Consulting

comprehensive accounting services

reporting

preparation for tax audits

Business registration

in the UAE and the GCC region

assistance in determining the jurisdiction suitable for your business

turnkey support for the registration of your business

obtaining a resident visa and Emirates ID

Market analysis in the UAE and the GCC region

studying the dynamics of the UAE and GCC market within your industry

analyzing competitors

helping to assess the potential of your business in the region

Additional services

capitalization

legal consulting

drafting contracts

transactional support

any other business support services

Schedule free bookkeeping consultation

Within the next hour, our experts will develop a plan of action

to address your issue

By clicking on the “Schedule free consultation” button, you give your consent to the processing of your personal information

Leave your details

Leave your details

General Director of SL Consulting

Leonid Strom

It would be more challenging for us without your assistance.

I would like to extend my sincere gratitude to the team at Global Tax Assistant for their exceptional support in maintaining our company's financial records.

Your team has proven to be a valuable asset to our organization, as all matters are addressed promptly and reports are submitted in a timely manner. We appreciate your commitment to ensuring that our employees have access to accurate and up-to-date information regarding accounting matters.

Without your expertise and dedication, it would be much more challenging for us to manage our financial affairs. We are confident in recommending Global Tax Assistant as a trustworthy and reliable partner.

I would like to extend my sincere gratitude to the team at Global Tax Assistant for their exceptional support in maintaining our company's financial records.

Your team has proven to be a valuable asset to our organization, as all matters are addressed promptly and reports are submitted in a timely manner. We appreciate your commitment to ensuring that our employees have access to accurate and up-to-date information regarding accounting matters.

Without your expertise and dedication, it would be much more challenging for us to manage our financial affairs. We are confident in recommending Global Tax Assistant as a trustworthy and reliable partner.

General Director of HATK company LLC

Yuri Hertz

Quick feedback, timely completion of tasks, and in-depth analysis of issues.

I have previously availed of the services of this company and found them to be of high quality. The advantages include fast feedback, timely completion of tasks, in-depth problem analysis, quick resolution of issues, and a wide range of potential solutions.

In addition, the pricing is reasonable. I would therefore highly recommend this company to others, expressing my gratitude and appreciation for the founder and team.

I have previously availed of the services of this company and found them to be of high quality. The advantages include fast feedback, timely completion of tasks, in-depth problem analysis, quick resolution of issues, and a wide range of potential solutions.

In addition, the pricing is reasonable. I would therefore highly recommend this company to others, expressing my gratitude and appreciation for the founder and team.

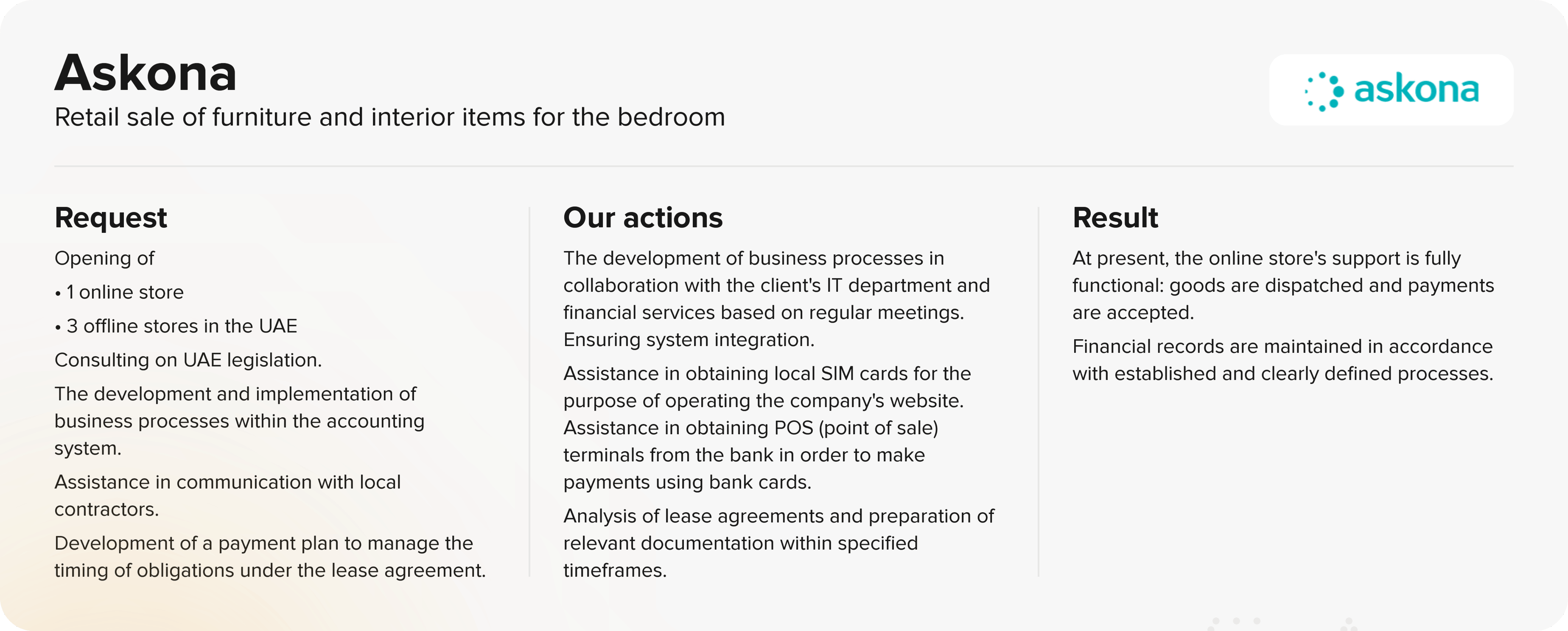

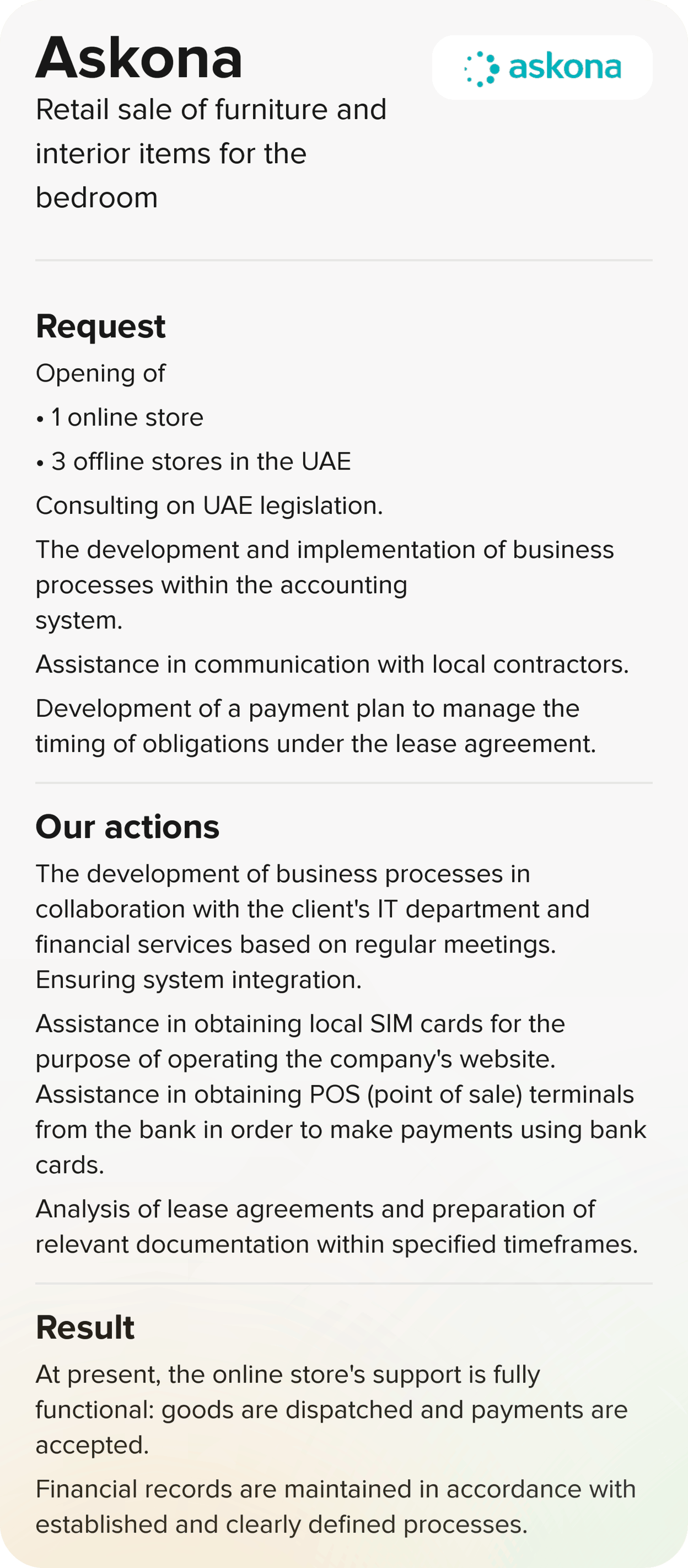

Head of Operational Support Department for International Projects Askona Group

Tatyana Ilina

I would like to express my sincere gratitude for the excellent service provided by your company. We are so pleased with your service that we do not even consider looking elsewhere.

Frankly speaking, we are extremely satisfied with the services provided by your company and have no desire to look elsewhere.

While this may seem trivial, your business demonstrates a human touch and is founded on an ethical and responsible approach. We truly appreciate this.

Frankly speaking, we are extremely satisfied with the services provided by your company and have no desire to look elsewhere.

While this may seem trivial, your business demonstrates a human touch and is founded on an ethical and responsible approach. We truly appreciate this.

Financial manager

Sergey Andreev

We have worked well together in the past and continue to interact.

The team helped me to register as a VAT payer and provided assistance with ongoing issues. They have helped us to remember the need to submit documents for reporting purposes, which is very important for us as we sometimes forget.

Thank you for your assistance.

The team helped me to register as a VAT payer and provided assistance with ongoing issues. They have helped us to remember the need to submit documents for reporting purposes, which is very important for us as we sometimes forget.

Thank you for your assistance.

IT company

OryxByte Software

GTA employees are always available to answer any queries you may have.

GTA fulfills its obligations in a timely and efficient manner.

The company's employees ensure that contracts, documents, and requests to various government and administrative organizations are processed in a professional manner. They also work closely with banks to facilitate the opening of accounts.

GTA's team of professionals is well-equipped to answer questions related to legal, financial, accounting, and tax matters, taking into consideration the requirements of UAE tax authorities and relevant legislation.

GTA fulfills its obligations in a timely and efficient manner.

The company's employees ensure that contracts, documents, and requests to various government and administrative organizations are processed in a professional manner. They also work closely with banks to facilitate the opening of accounts.

GTA's team of professionals is well-equipped to answer questions related to legal, financial, accounting, and tax matters, taking into consideration the requirements of UAE tax authorities and relevant legislation.

Director of Sergei Kodolov Technical Services

Sergei Kodolov

Last year, Sergei Kodolov Technical Services selected Global Tax Assistant to be its partner in organizing and maintaining financial and tax reporting. We are pleased with this decision.

Our expectations for cooperation with Global Tax Assistant have been fully met.

In the current business environment in the UAE, the high level of expertise among Global Tax Assistant's staff in accounting, taxation, and Dubai-specific legislation is particularly significant.

The team's competence, prompt resolution of issues, and commitment to responsibility make cooperation with them a pleasant, productive, and effective experience.

Our expectations for cooperation with Global Tax Assistant have been fully met.

In the current business environment in the UAE, the high level of expertise among Global Tax Assistant's staff in accounting, taxation, and Dubai-specific legislation is particularly significant.

The team's competence, prompt resolution of issues, and commitment to responsibility make cooperation with them a pleasant, productive, and effective experience.

General Director of AirBridge

Alexander Fillipov

Hello everyone! My name is Alexander Filippov, I am the founder of CDC AirBridge company. I work with Smbat, he is an excellent professional. I recommend him to everyone!

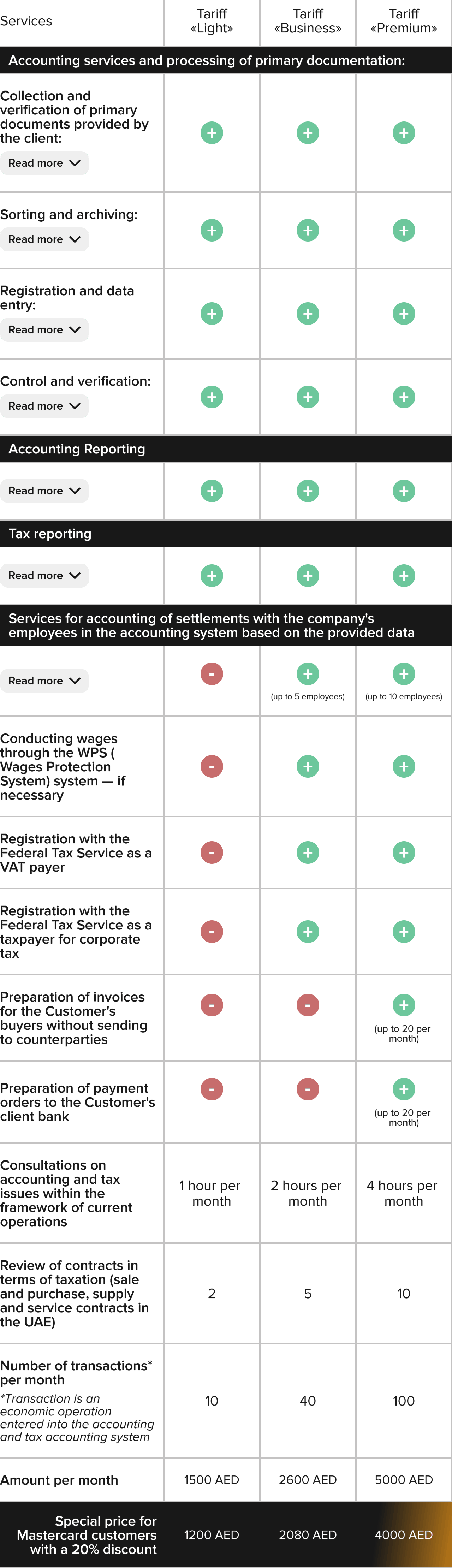

Special offer for Mastercard customers

Comprehensive bookkeeping service with annual maintenance

Leave your details

Leave your details

Leave your details

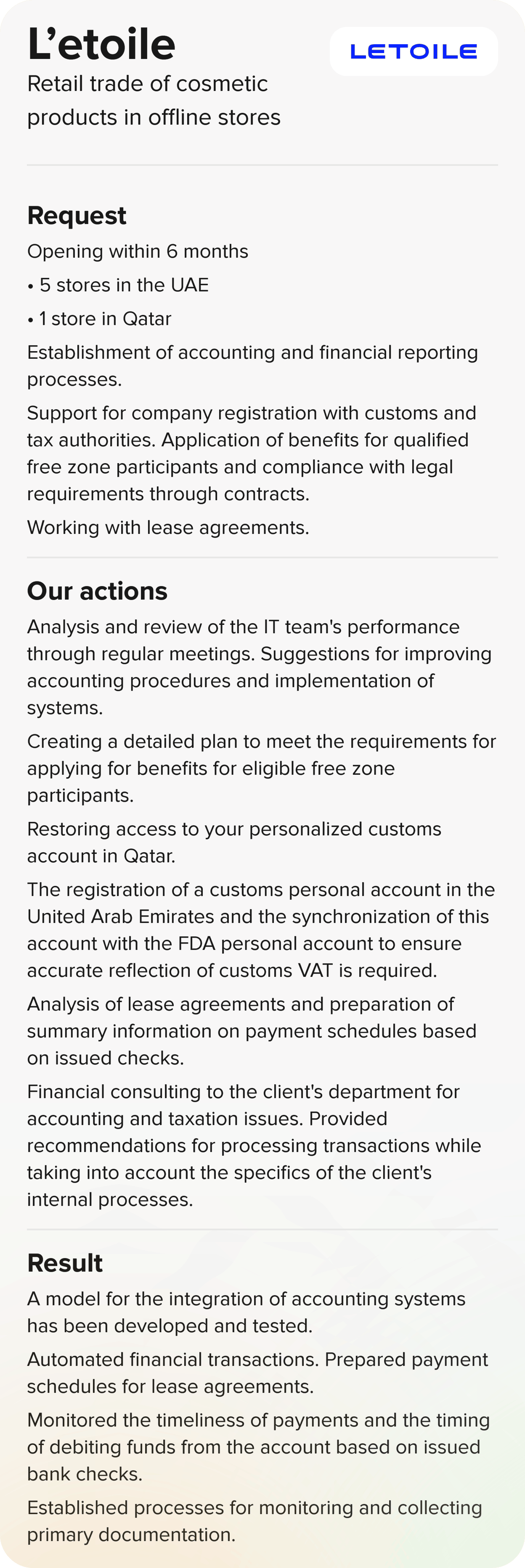

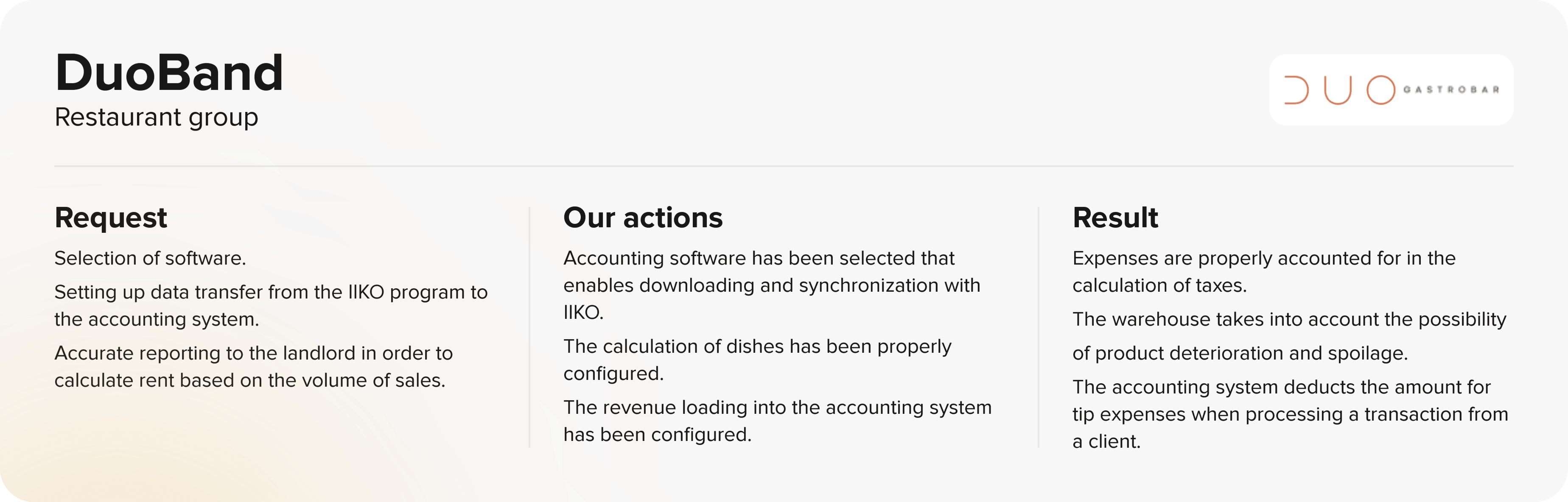

Collection and verification of primary documents provided by the client:

- Prepayment receipt, Proforma invoice, Commercial or normal invoice, Tax invoice (closing document with VAT) f or purchase and sale of goods, works and services Payment orders and cash vouchers, checks, advance reports, Bank statements and reports, Checking compliance with contracts and primary documentation

- Maintaining records of fixed assets and intangible assets

Sorting and archiving:

Sorting and storing client transmitted copies of documents by category and period according to established guidelines

Registration and data entry:

- Data entry into the accounting system based on the primary documents provided

- Registration of received documents in the accounting system

- Checking and confirming the correctness of the entered data

Control and verification:

- Checking whether primary documents comply with internal rules and legal requirements

- Verification of the data for correctness and completeness, return of documents for correction and correction of errors in case of errors. Correcting and correcting errors, if necessary

- Report preparation and analytics

- Analyzing data for financial statement preparation, Period closing, including routine operations on depreciation, revaluation of currency accounts, interest accrual

- Preparation and submission of financial (accounting) statements in accordance with the legislation

- Preparation and submission of tax reporting in accordance with the legislation

- Reconciliation of tax and levy settlements with tax authorities

- Responding to inquiries from tax authorities on declarations filed in the current period

- Reflection of operations on accrual and payment of wages in accordance with the labor contract, provided timesheet, accrual of bonuses and bonuses and other payments in accordance with the bonus policy

- Entering initial data about the employee into the accounting system, reflection of personnel accounting data in the program

- Entering operations on accrual of vacation reserves — preparation of certificates confirming employment and salary level at the request of employees — salary certificate

Focus on developing your business, and we’ll take care of the rest

GLOBAL TAX ASSISTANT — Your reliable partner and key ally in business. You can peacefully focus on growing your company, entrusting us with

all the “headaches”.

Any questions?

Schedule free bookkeeping consultation

By clicking on the “Schedule free consultation” button, you give your consent to the processing of your personal information

GLOBAL TAX ASSISTANT - FZCO

License No25698

Address: IFZA Property FZCO

Dubai Silicon Oasis, DDP, Building A2, Dubai, United Arab Emirates